The Philippines came up number 41, up one notch from being number 42 last year in terms of world competitiveness, above Indonesia but below Mexico, according to IMD, a top global business school in Switzerland and Singapore.

Asian economies showed mixed results though many declined corresponding with a drop in their domestic economies plus weakening/aging infrastructure, according to the annual IMD ranking of 61 countries released yesterday.

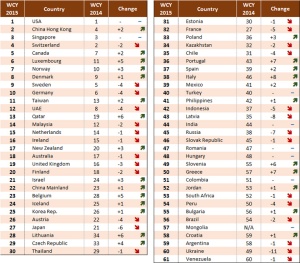

Malaysia’s ranking plunged from 12 to 14; Japan, from 21 to 27; Thailand, from 29 to 30 and Indonesia, from 37 to 42 although Taiwan moved up from 13 to 11 and the Republic of Korea edged up slightly from 26 to 25.

The USA remains at the top of the ranking buoyed by its strong business efficiency and financial sector, its innovation drive and the effectiveness of its infrastructure.

Hong Kong, ranked number 2 and Singapore close behind at number 3, moved up overtaking Switzerland, which dropped to fourth place.

Canada ranked number 5; Norway, number 7; Denmark, number 8; Sweden, number 9 and Germany, number 10, remained in the top 10. Luxembourg moved to the top 6 from 11th place in 2014.

As part of its ranking, the IMD World Competitiveness Center also looks at several aspects of each country as a place to conduct business. The overall ranking also reflects more than 300 criteria, two-thirds of which are based on statistical indicators and one-third on an exclusive IMD survey of 6,234 international executives.

“A general analysis of our 2015 ranking shows that top countries are going back to the basics,” observed Professor Arturo Bris, Director of the IMD World Competitiveness Center.

“Productivity and efficiency are in the driver’s seat of the competitiveness wagon. Companies in those countries are increasing their efforts to minimize their environmental impact and provide a strong organizational structure for workforces to thrive,” he elaborated.

Significantly, Eastern Europe also experienced a mixture of results in the IMD study.

Poland moved up from 36 to 33; the Czech Republic, from 33 to 29 and Slovenia, from 55 to 49. However, the Baltic States were demoted – Estonia (30 to 31) and Latvia (35 to 43) although, Lithuania gained in the ranking (34 to 28).

Elsewhere in the region, current events in Russia (38 to 45) and Ukraine (49 to 60) highlight the negative impact that armed conflict and the accompanying higher market volatility have on competitiveness in an increasingly interconnected international economy.

IMD showed a pattern of decline in Latin America. Chile moved from 31 to 35, Peru from 50 to 54, Argentina from 58 to 59 and Venezuela remained at the bottom of the table. Colombia stayed at 51.

Among large emerging economies, Brazil (54 to 56) and South Africa (52 to 53) slightly dropped, China (23 to 22) and Mexico (41 to 39) experienced improvements while India remained at the same spot (44).

This trend showed the difficulty in grouping emerging markets in one category, as the issues affecting their competitiveness differ.

China’s slight increase stemmed from improvements in education and public expenditure, whereas Brazil suffered from a drop in domestic economy and less optimistic executive opinions.

Nevertheless, the ranking highlights a particular commonality among the best ranking countries. Nine countries from the top 10 also made it in the top 10 of the business efficiency factor.

Business efficiency focuses on the extent to which the national environment encourages enterprises to perform in an innovative, profitable and responsible manner.

It is assessed through indicators related to productivity such as the labor market, finance, management practices and the attitudes and values that characterize the business environment.

“Simply put, business efficiency requires greater productivity and the competitiveness of countries is greatly linked to the ability of enterprises to remain profitable over time,” stressed Professor Bris. “Increasing productivity remains a fundamental challenge for all countries.”

Long-term business profitability and productivity are difficult to achieve because they are largely underpinned by the strategic efforts of companies striving to maximize positive externalities that originate in economic activities.

Luxembourg experienced one of the largest gains in this factor (14 to 4) which greatly contributed to its ascendency in the ranking.

Qatar’s improvement (19 to 13) in the ranking largely reflected its recovering in terms of the business efficiency factor (24 to 11) due to increases in its overall productivity.

Greece’s recovery (57 to 50) also came on a strong performance in business efficiency in which it increased from 54 to 43.

The UAE’s drop (8 to 12) in the ranking was partly the result of lower scores (15 to 18) in the business factor.

Similarly, Germany’s retreat (6 to 10) reflected its fall in business efficiency (9 to 16). Likewise Indonesia’s decline in the ranking is accompanied by a steep drop in the business efficiency factor (22 to 34).

Mongolia was a new addition to the competitiveness ranking in 2015.

Mongolia is a fast-growing country (11.6% GDP growth, 2013). Although, growth slowed to 5.3% in 2014 (data for the first half of the year), the country’s economic performance remained strong.

Growth is driven by mining and natural resources, domestic consumption growth, levels of employment, an education system that promotes talent, and a favorable fiscal environment for enterprises.

During the 2013-2014 period, however, Mongolia experienced a 74% decline in foreign direct investment which may reflect investor perceptions of the country’s political and financial stability, its adherence to rule of law, the soundness of its corporate governance practices and imbalance risk-return trade-offs.